How PrimeRates Works

PrimeRates provides access to personalized business loan offers through our simple and quick pre-qualification application. Once you're pre-qualified, you can select the best offer for you and finalize the business loan application with the lender.

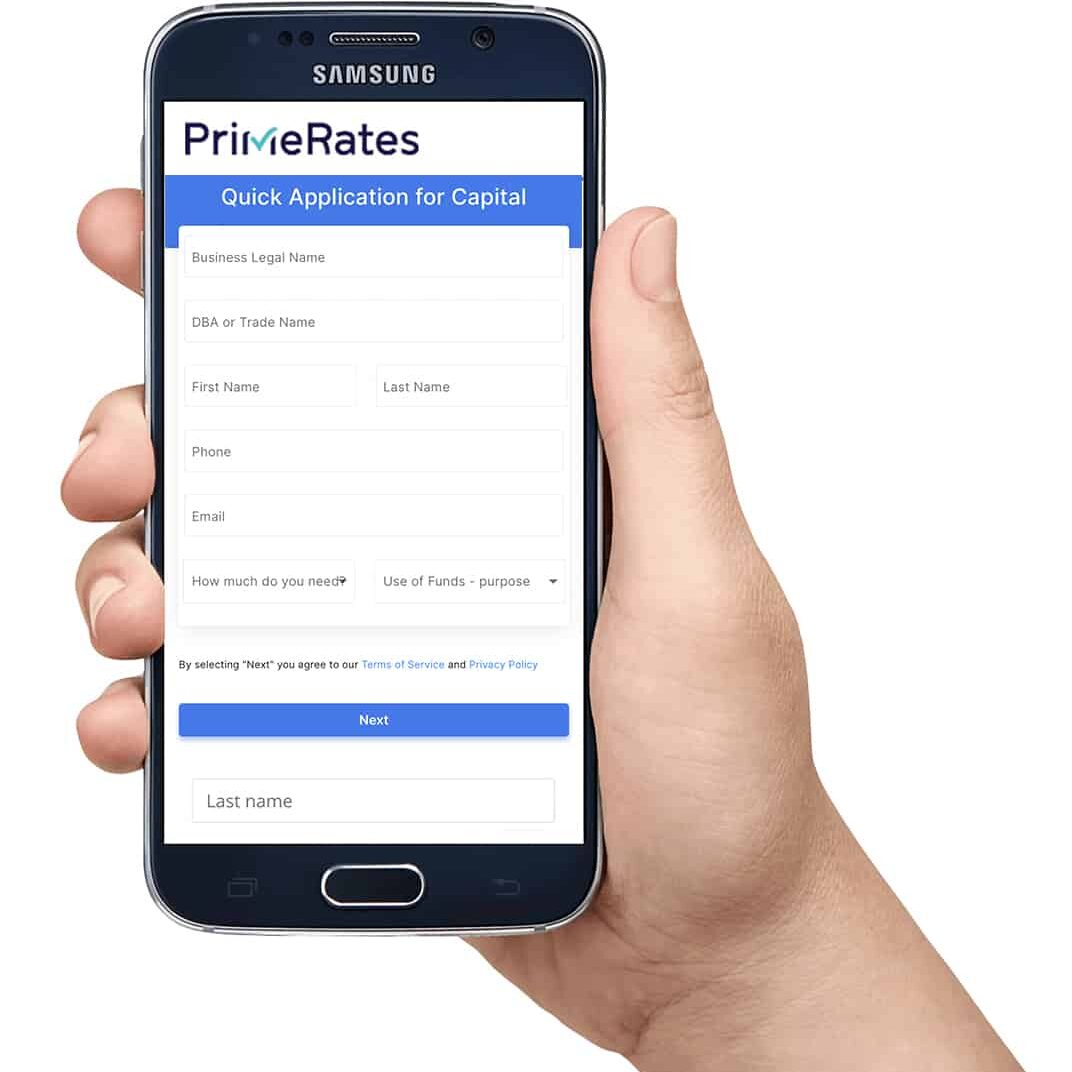

Apply in minutes

Our simple application takes less than 5-7 minutes to complete.

Select your business loan offer

Choose the offer that best fits your needs by comparing loan amounts and terms.

Receive funds quickly

Finalize your loan offer with the lender you selected to receive your funds.

PrimeRates Guide to Small Business Loans in Colorado

Small businesses are needed to keep funds circulating in the local economy, support community revitalization efforts, drive innovation, create job opportunities, and ensure economic growth and development. If you have a small business in the state of Colorado, we’ve compiled some resources to help you take advantage of business loans, grants, and other opportunities to grow your business.

How a loan can help your small business in Colorado

Taking out a small business loan is a great way to grow and expand your existing business or help cover the start-up costs associated with starting a new company. Small business loans can cover everything from legal expenses and marketing materials to staffing needs and new equipment financing. Another common reason to use a small business loan is to improve cash flow, especially if you have a seasonal business. Before taking out financing you should have a clear vision and plan. Afterall, financing does cost money so you’ll want to make sure the investment is worth it.

Types of small business financing options in Colorado

There are several different types of financing that business owners can consider for funding the start-up costs, expansion expenses, or the day-to-day operations of their business. These include:

- SBA loans: To access some of the best small business loans, consider an SBA loan. Loans that are backed by the Small Business Administration include general small business 7(a) loans, microloans, Real Estate & Equipment (504) loans, and disaster loans. The SBA is a government agency committed to helping small businesses thrive. Since they back the loans, there’s less risk for the lender. While the terms are known to be favorable, qualifying for an SBA loan can be a time-consuming process. It may take weeks or months to receive your funding. To apply for an SBA loan, locate an SBA approved lender near you.

- Online business loans: Online business loans are a smart way to access funds quickly, but sometimes come at a cost. If you shop carefully though, you can find competitive business loans online. In addition, the loans may have less strict requirements to qualify. Whether you use a lender that is solely online or a big name bank that offers loans online, the online marketplace is competitive, thus increasing your chance of approval. To compare business loans online, visit Primerates.

- Term loans: Traditionally, most business loans are structured as term loans and can be obtained from national and local banks. Term loans usually offer applicants a fixed interest rate that results in predictable monthly payments during the repayment period. A business term loan is a simple and reliable way to get the financing your business needs.

- Commercial business loans: A commercial business loan may be used to finance a vehicle, real estate purchase, or construction costs of a new or existing commercial business. These loans give companies the working capital they need to finance major purchases and expenses. Commercial mortgages, construction loans, and auto loans may be offered by a bank, credit union, or online lender.

- Business credit cards: Business credit cards can help small businesses monitor spending and improve cash flow. However, they are not the best way to float money or finance purchases. Overspending on a credit card can lead to a cycle of debt that can eventually destroy your business. If you use a credit card, be sure to pay the balance in full every month.

- Lines of credit: A line of credit is similar to a credit card, but with lower interest rates and higher limits. A line of credit is typically secured by an asset. A business line of credit can be drawn on (as long as the amount does not exceed the available limit). Then, interest will only be charged on the money you draw. A line of credit can help seasonal businesses or inventory heavy businesses.

Small business financing resources in Colorado

The U.S. Small Business Administration (SBA) is a good starting point for businesses in any state to access resources and information about financing options including loans, investment capital, disaster assistance, surety bonds, and grants. SBA-backed loans are a popular option for many entrepreneurs.

Colorado business owners can benefit from a thorough review of the information and resources available from the Colorado Office of Economic Development & International Trade (OEDIT). Their online database of local resources hosts a large number of programs and funding that businesses can take advantage of including grants, training programs, tax credits, conferences, loans, and scholarships.

Business owners can also access grants and other resources from their local Small Business Development Center, such as the Southeast Colorado SBDC.

Other state agencies that business owners can check for grants include the Colorado Department of Education, Colorado Department of Human Services, Colorado Department of Local Affairs, and many others. Business owners can check for grants at the local and county level as well.

On the federal level, small business grants are also available through various sources including the SBA, USDA and other government agencies.

Small business grants available in Colorado

A small business grant is a way of funding your business that is considered to be a gift of financial assistance that does not need to be paid back. Small business grants may be obtained through government agencies, corporations, organizations, and other sources for the purposes of helping business owners succeed and stimulating the economy. Many grant programs focus on providing funds to areas of specialized focus such as women, veterans, or minorities.

In the state of Colorado, there are several places business owners can go to seek out small business grants.

- State Trade Expansion Program (STEP) Grant can award funds of up to $15,000 to help small businesses expand via international business development activities (such as attending trade shows or updating marketing materials for an international audience).

- Colorado First and Existing Industry Job Training Grant Program provides grants to businesses in need of new hire training or incumbent worker training.

- Colorado Community Revitalization Grant allows businesses in certain areas to receive up to $5 million per project to revitalize buildings or start new construction.

- Business Foundations Technical Assistance Program provides training and funds up to $1,200 for small businesses looking to get established who need assistance with legal formation, accounting, and digital marketing.

Tips for applying for a small business loan in Colorado

When it comes time to consider obtaining financing for your business, there are a few things you can do to increase your odds of approval and help you land the best deal on a business loan.

- Create a business plan: The first step toward preparing to apply for a small business loan is to create a business plan. Not only do most lenders require a written business plan to approve applicants for financing but having a business plan can increase your chances of success in your business.

- Ensure you have a good credit score: Before applying for a business loan or any other type of financing, you should make sure that your personal finances are in order. This includes keeping an eye on your credit reports and building up your credit score as much as possible before applying. In order to get access to the best interest rates, applicants should ideally have a credit score of at least 660 and above, which is considered a “Prime” credit score.

- Get your paperwork in order: Additional documentation that small business loan lenders may request include financial statements, profit and loss statements, earnings reports, tax returns, bank statements, and other proof of your business information. Some lenders may require a certain amount of annual revenue or income in order to approve you for a loan. Others may require that your company has been in business for a certain amount of time. Having all of your business paperwork in order and ready to go will save you time during the application process.

- Consider using a local credit union: Be sure to check out credit unions near you and compare the rates and terms of their business loan programs with that of online lenders and traditional banks. Some of the top credit unions in the state of Colorado include Power Credit Union, Delta County Federal Credit Union, NuVista Federal Credit Union, and Navy Federal Credit Union. Membership is typically based upon the location of your residence, educational institution, or employer.

To obtain a small business loan in the state of Colorado, consider your financing options, select your preferred type of financial institution, and prepare your business plan and other documentation.

To increase your chances of finding the best deal, compare interest rates and loan terms before moving forward with a loan offer.

Compare rates and get funded

We encourage you to take the time to research all of your options and find the loan that will help your business grow and succeed. If you’re a small business owner in Colorado, it’s worth considering a small business loan. Loans can give your business the boost it needs to grow and succeed. At PrimeRates, we work with a variety of lenders who offer loans for businesses of all sizes. Within a few minutes you can receive personalized business loan offers that you actually qualify for - all without impacting your credit score. Say goodbye to the days of window shopping interest rates and unlock offers that you can actually take advantage of.

Unlock competitive small business loans in Colorado. . . check offers at Primerates today!

Small Business Loans By State

Recent Articles

Business Loans By Industry

- Bed & Breakfast Business Loans

- Commercial Cleaning Services Loans

- Daycare Business Loans

- Food Truck Financing Options

- Farm & Agriculture Business Loans

- Auto Loans For Business Owners

- Business Loans For Medical Practices

- Restaurant Business Loans

- Flooring Company Loans

- Spa Business Loans

- Self Storage Business Loans

- Business Loans for Bars

- Car Wash Business Loans

- Chiropractic Practice Loans

- Law Firm Financing Options

- Business Loans For Beauty Salons

- Business Loans For Construction Companies

- Insurance Agency Business Loans

- Business Loans for Retail Stores

- Dental Practice Loans

- Franchise Financing Options

- Oil and Gas Business Loans

- Fintech Business Loans

- Business Loans For General Contractors

- Auto Repair Shop Business Loans

- Grocery Store Business Loans

- Clothing Store Business Loans

- E-Commerce Financing

- Hospitality Loans

- Pharmacy Business Loans

- IT Company Loans

- Photography Business Loans

- Wholesale Distributor Financing

- Veteran Business Loans

- Business Loans for Uber Drivers

- Bakery Business Loans

- Convenience Store Financing

- Pet Store Financing

- Gas Station Financing

- HVAC Business Loans

- Veterinary Business Loans

- Business Loans For Hotels

- Business Loans For Gyms

- Business Loans for Landscaping Business

- Restoration Equipment Financing

- SBA Loans

- Vending Machine Business Loans