How PrimeRates Works

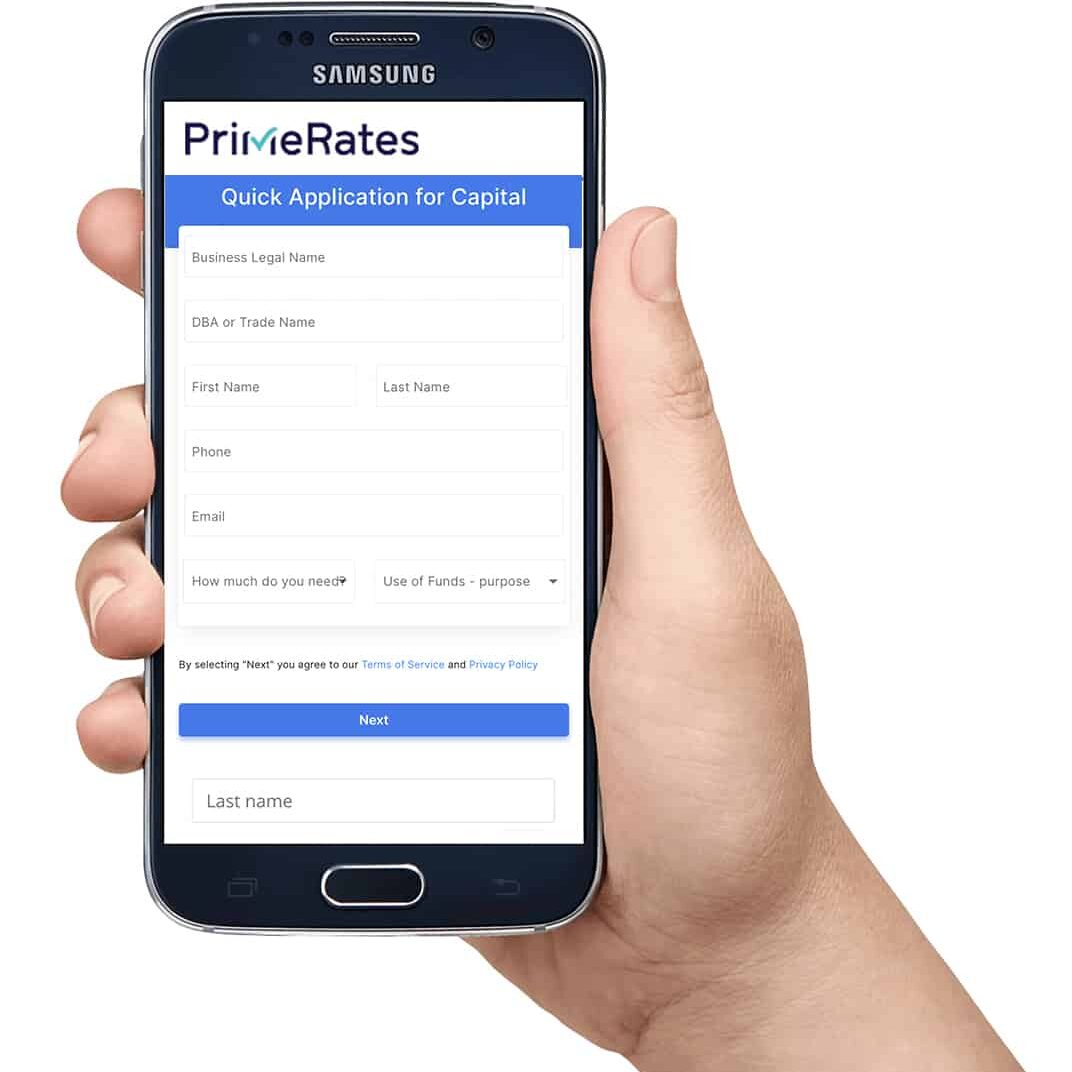

PrimeRates provides access to personalized business loan offers through our simple and quick pre-qualification application. Once you're pre-qualified, you can select the best offer for you and finalize the business loan application with the lender.

Apply in minutes

Our simple application takes less than 5-7 minutes to complete.

Select your business loan offer

Choose the offer that best fits your needs by comparing loan amounts and terms.

Receive funds quickly

Finalize your loan offer with the lender you selected to receive your funds.

PrimeRates Guide to Small Business Loans in Arizona

How a loan can help your small business in Arizona

If you're a small business owner in Arizona, you know that loans can be hard to come by. Banks are often reluctant to lend money to businesses that don't have a long track record of success. However, there are a number of ways that a loan can benefit your small business.

A small business loan can provide the financial boost your business needs to grow and succeed. There are many common uses for small business loans, such as purchasing inventory, hiring new employees, or opening a new location. A loan can also help you to improve your cash flow, which can be a major challenge for small businesses.

However, it's important to remember that a loan should only be used for business-related expenses. Personal expenditures, such as vacations or a new car, are not allowed. Instead, the loan must be used to generate revenue and help your business reach its full potential. When used wisely, a small business loan can be the key to taking your business to the next level.

Additionally, a loan can give you the opportunity to take advantage of early-payment discounts or special financing offers. Ultimately, a loan can be a valuable tool for small businesses in Arizona if it’s used wisely.

Types of small business financing options in Arizona

If you own a small business in Arizona, you have a few different options when it comes to financing. Before applying for a loan you should explore your options and determine exactly what you need the money for. Let’s take a look at some small business financing options in Arizona.

SBA loans

The Small Business Administration (SBA) offers a variety of loan programs designed to help small businesses get the financing they need. These loans are backed by the government and designed to favor small businesses.

Online business loans

Online business loans can deliver fast funding. There are a number of online lenders that offer loans specifically for small businesses. Oftentimes the requirements are less strict.

Commercial business loans

Commercial loans are typically used for larger projects, such as expansion or renovation.

Business credit cards

Business credit cards offer revolving lines of credit that can be used for everyday expenses, such as office supplies or travel. While they may not be the best source of financing per say, they can help improve cash flow and monitor spending.

Lines of credit

Lines of credit are similar to credit cards, but they are typically secured by collateral. You will need to repay the money you draw with interest.

Small business financing resources in Arizona

When it comes to starting or growing a small business in Arizona, there are a number of financing resources available. The Arizona Commerce Authority offers a variety of programs designed to support small businesses, including loans, grants, and tax incentives.

The Small Business Innovation Research Program provides funding for early-stage research and development projects. Essentially, it is a competitive grant program that provides funding for early-stage research and development projects. Eligible applicants include small businesses, university-affiliated research institutes, and non-profit organizations. SBIR grants are awarded through a competitive process, and recipients must match the grant funds with private sector investment.

And then there is the Arizona Small Business Association. This organization offers a range of membership benefits, including access to financing options. With so many financing resources available, there's no excuse not to pursue your entrepreneurial dreams in Arizona. Dig in and chase your dreams.

Small business grants available in Arizona

Did you know that there are numerous grants available to small businesses in Arizona? In fact, the state of Arizona has a wide variety of grant programs designed to help businesses start up and grow. One such program is the Arizona Commerce Authority Seed Fund, which provides funding for early-stage companies.

The Arizona Department of Housing also offers a Small Business Assistance Program, which provides grants for businesses that create affordable housing options. There are also a number of grant programs available through the U.S. Small Business Administration, including the Phoenix Revolving Loan Fund and the SBA 7(a) Loan Program. So if you're looking for financial assistance to start or grow your small business, be sure to check out all the grant options available in Arizona.

Tips for applying for a small business loan in Arizona

Applying for a loan can be a daunting task, but with a little preparation, you can increase your chances of being approved. If you're hoping to secure a small business loan in Arizona, here are a few tips to keep in mind.

Create a business plan

First, it's important to create a detailed business plan that outlines your proposed use for the funds. Be sure to include financial projections and a solid marketing strategy. Be sure to include information on your target market, expected costs, and projected revenue. You may also need to provide personal financial statements for all owners of the business. These documents will help lenders assess your creditworthiness and determine whether you have the ability to repay the loan.

A good credit score can give you a leg up

A credit score is a number that lenders use to determine how likely you are to repay a loan. The higher your score, the more likely you are to be approved for a loan and to get a lower interest rate. For small business loans, the minimum credit score required is usually around 640, although this can vary depending on the type of loan and the lender.

If you have a lower credit score, you may still be able to get a loan, but you may need to provide additional collateral or pay a higher interest rate. Improving your credit score before applying for a loan can help you get the best terms possible. There are a few things you can do to improve your score, including paying your bills on time, maintaining a good credit history, and using a mix of different types of credit.

Having a strong credit score will give you a better chance of being approved for a loan. Before you apply, be sure to order a copy of your credit report and take steps to improve your score if necessary.

Get your paperwork in order

Finally, be sure to get your paperwork in order. This includes tax returns, bank statements, and proof of collateral. Loan requirements vary depending on the lender, so take some time to research what’s necessary for your specific Arizona small business loans.

By following these tips, you'll be on your way to securing the small business loan you need.

Where can you compare business loan rates?

If you're a small business owner in Arizona, you know that one of the keys to success is finding the right financing.

With so many options available, it can be difficult to know where to start. However, when it comes to small business loans, there's one name that stands out: PrimeRates. PrimeRates allows you to compare loan offers for Arizona small business loans from lenders all around the country.

PrimeRates offers access to some of the most competitive rates in the state, but they also have a team of experts who are dedicated to helping businesses get the funding they need. When you're ready to take your business to the next level, make sure you compare rates and get funded with PrimeRates.

Wrapping up

If you’re a small business owner in Arizona, it’s worth considering a small business loan. Loans can give your business the boost it needs to grow and succeed. At PrimeRates, we work with a variety of lenders who offer loans for businesses of all sizes. Within a few minutes you can receive personalized business loan offers that you actually qualify for - all without impacting your credit score.

Unlock competitive small business loans in Arizona. . . check offers at Primerates today!

Small Business Loans By State

Recent Articles

Business Loans By Amount

Business Loans By Industry

- Bed & Breakfast Business Loans

- Commercial Cleaning Services Loans

- Daycare Business Loans

- Food Truck Financing Options

- Farm & Agriculture Business Loans

- Auto Loans For Business Owners

- Business Loans For Medical Practices

- Restaurant Business Loans

- Flooring Company Loans

- Spa Business Loans

- Self Storage Business Loans

- Business Loans for Bars

- Car Wash Business Loans

- Chiropractic Practice Loans

- Law Firm Financing Options

- Business Loans For Beauty Salons

- Business Loans For Construction Companies

- Insurance Agency Business Loans

- Business Loans for Retail Stores

- Dental Practice Loans

- Franchise Financing Options

- Oil and Gas Business Loans

- Fintech Business Loans

- Business Loans For General Contractors

- Auto Repair Shop Business Loans

- Grocery Store Business Loans

- Clothing Store Business Loans

- E-Commerce Financing

- Hospitality Loans

- Pharmacy Business Loans

- IT Company Loans

- Photography Business Loans

- Wholesale Distributor Financing

- Veteran Business Loans

- Business Loans for Uber Drivers

- Bakery Business Loans

- Convenience Store Financing

- Pet Store Financing

- Gas Station Financing

- HVAC Business Loans

- Veterinary Business Loans

- Business Loans For Hotels

- Business Loans For Gyms

- Business Loans for Landscaping Business

- Restoration Equipment Financing

- SBA Loans

- Vending Machine Business Loans