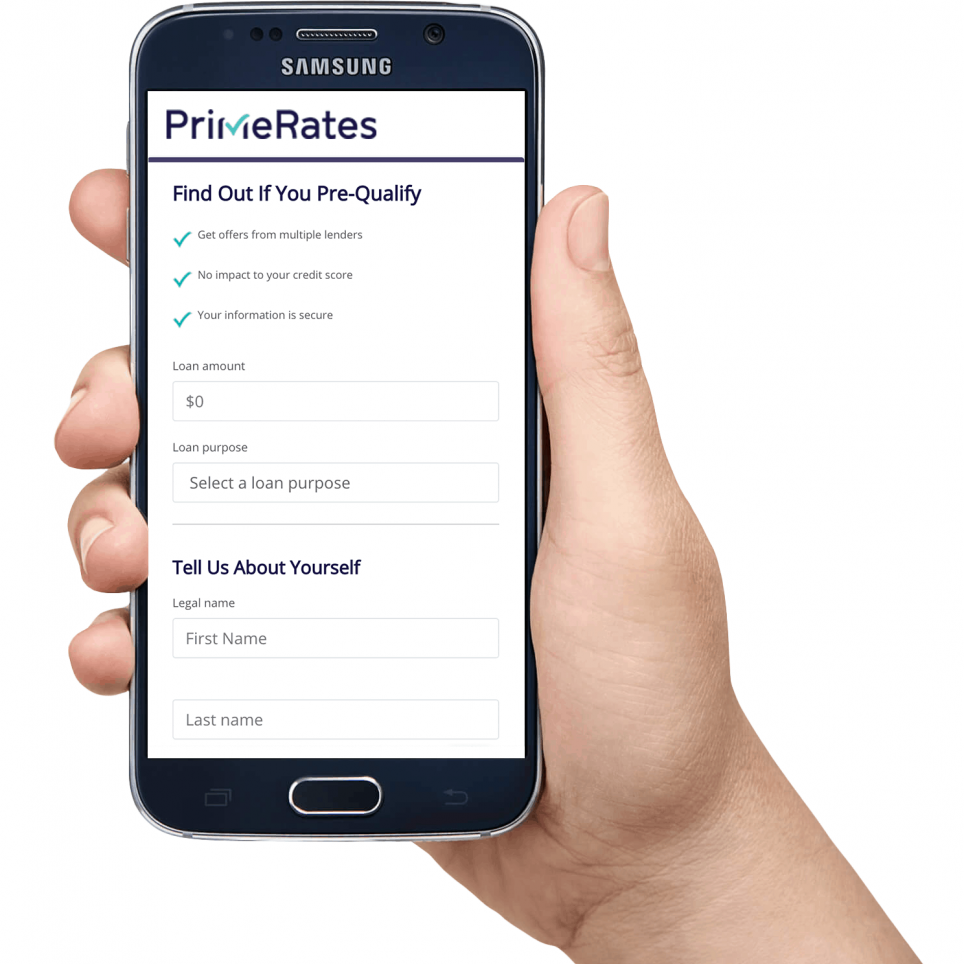

Get your rate in minutes

No credit score impact

Borrow up to $100,000

How PrimeRates Works

PrimeRates provides access to personalized loan offers through our simple and quick pre-qualification application. Once you're pre-qualified, you can select the best offer for you and finalize the loan application with the lender.

Apply in minutes

Simple pre-qual application in less than 1 minute.

Select your loan offer

Choose the offer that best fits your needs.

Receive funds quickly

Finalize your loan offer, get approved, and receive funds.

Best Personal Loans $35,000 & Above

What credit score do you need for a $35,000 personal loan?

Borrowers should have a credit score above 620 to improve their chances of getting approved for a loan with a low interest rate and flexible repayment terms. While 620 is the minimum that a borrower should have, a credit score of 680 or above will help make applicants eligible for the lowest rates offered by a lender. Even if your credit score doesn’t meet either of these marks, however, there still may be personal loans of $35,000 that you can qualify for.

How much would a monthly payment be on a $35,000 loan?

A monthly payment on a $35,000 loan depends on the loan repayment terms, which are typically between two and five years on a loan of this size. For example, if you take out a loan of $35,000 with a 15.6% APR and four-year repayment term, your minimum monthly payment will be $984.75.

How does APR work on a $35,000 personal loan?

APR, or annual percentage rate is the amount of interest on the loan combined with any additional anticipated costs of the loan including an origination fee, which is typically between 0.99% and 5.99%, prepayment fees and check processing fees. If a loan does not have any additional fees, however, the APR will simply be equal to the interest rate.

Do I get access to all $35,000 right away?

A personal loan is almost always made entirely available to the borrower upon first disbursement. If you’re taking out a personal loan of $35,000, the lender will likely disburse the entire amount of the loan to your bank account within one business day to two weeks, depending on where you applied. However, even when the lender disburses the entirety of the loan, your individual bank may have additional processing times or limitations on how much money you can access at once.

How to Apply and Get a $35,000 Loan With Bad Credit

In order to apply for a personal loan of up to $35,000, you should have your personal credit score, recent bank statements and personal contact information available. Additionally, some lenders may also require a personal statement as to the reason why you’re taking out the loan and what you plan to do with it. Once you apply, it is up to the many lenders to approve your application if you have bad credit.

Best personal loans $35,000 and above

Now that you’re looking for a $35,000 personal loan, you might be wondering where to start. Let’s take a look at some of the best personal loan lenders and loan-matching services:

Credible

|

|

| APR range | 5.34 — 35.99% |

| Available loan terms: | 24 to 84 months |

| Loan amounts: | Up to $100,000 |

| Time to fund: | Varies |

| Origination fee: | Varies |

| Credit score needed: | Fair to Excellent |

| Income needed: | No Minimum |

| Soft Credit Check? | Yes |

| Best for: | Refinance your student loans, consolidate debt |

| Click "Check Rates" to apply to Credible | |

Best For: Credible connects borrowers with personal loans between $1,000 and $100,000 for anything from minor home repairs to vehicle down payments and renovations. This lender is ideal for borrowers who have good to excellent credit who are looking to compare multiple loan offers using just one application.

Pros

- One form provides access to multiple lenders

- Quick to fund, with many loans funding within as little as one business day

- No extra fees to use the service or to apply

- Potential for APRs as low as 5.34%

- Flexible loan repayment terms of up to seven years

Cons

- Potential for high or extra fees, depending on the lender

- Smaller selection of lenders than other online loan-matching services

- Third-party lending means customer service might not be as accommodating as with a direct lender

LightStream

|

|

| APR Range: | 3.99 — 16.99% with AutoPay |

| Loan Terms: | 2 to 12 years |

| Loan Amount: | $5,000 — $100,000 |

| Time to Funding: | As soon as same day |

| Credit Score: | 660+ |

| Income: | N/A |

| LightStream: | Read Our Review |

| Click "Check Rates" to apply to LightStream | |

Best For: Due to LightStream’s long repayment terms and low annual percentage rates, their loans are best for borrowers with excellent credit scores who are looking to make home improvements or consolidate debts.

Pros

- Allows co-signers

- APRs as low as 3.99%

- No origination, late fee or prepayment fees

- Maximum APR of 16.99%

- Autopay option

- Rate beat program

Cons

- Difficult for borrowers with average credit to qualify, with a minimum credit score requirement of 660

- Hard credit pull on loan applications

FreedomPlus

|

|

| APR: | 4.99% — 29.99% |

| Loan Terms: | 2 to 5 years |

| Loan Amount: | $10,000 — $35,000 |

| Time to Fund: | As little as 2 days |

| Minimum Credit Score: | 640+ |

| Income: | $30,000+ |

| Soft Credit Check? | Yes |

| FreedomPlus | Read Our Review |

| Click "Check Rates" to apply to FreedomPlus | |

Best For: FreedomPlus is best for high credit and established borrowers who are looking to consolidate debts of up to $40,000 with direct payments made to creditors.

Pros

- Rates as low as 5.99%

- Repayment terms of up to five years

- Option to apply with co-signer or joint applicant

- Monthly repayments

Cons

- Minimum loan amount of $7,500

- Difficult for borrowers with credit scores below 670 to qualify

- Not available in several U.S. states including New York, New Hampshire and North Dakota

BestEgg

|

|

| APR Range: | 5.99%—29.99% |

| Loan Terms: | 3 to 5 years |

| Loan Amount: | $2,000—$50,000 |

| Time to Funding: | As early as same day |

| Credit Score: | 600+ |

| Income: | n/a |

| Best Egg | Read Our Review |

| Click "Check Rates" to apply to BestEgg | |

Best For: BestEgg is best for borrowers with high credit scores who are looking for funding for small to medium-sized home improvement projects, debt consolidation or vehicle down payments.

Pros

- Funding in as little as one business day

- Flexible repayment terms of three to five years

- Easy, fast online application

- Relatively low APRs, with a maximum of 29.99%

Cons

- Borrowers with credit scores below 600 or low annual incomes may have trouble qualifying

- Loan amounts are limited to $2,000 to $50,000

- Potential for high origination fees of up to 5.99%

- $15 late fee

- $15 returned payment fee

How to tell if you need a 35000 personal loan

Deciding whether you need a 35,000 personal loan involves evaluating your financial situation, goals, and the potential impact on your finances. Here are some indicators that a 35K personal loan might be right for you:

Consolidating High-Interest Debt: If you have multiple high-interest debts (such as credit card balances), consolidating them into a single, lower-interest personal loan can save you money on interest and simplify your payments.

Funding a Large Expense: Whether it's a home renovation, a significant medical bill, a wedding, or funding education, a personal loan can provide the funds you need when savings are not sufficient.

Improving Your Home: Investments in home improvement not only enhance your living space but can also increase your home's value. If the improvement leads to significant value addition, a personal loan can be a good financing option.

Refinancing Existing Loans: If you can secure a personal loan with a lower interest rate than your current loans or credit lines, refinancing can reduce your monthly payments and the total cost of the loan.

Building Credit: For those with limited credit history or looking to improve their credit score, taking out a personal loan and making timely payments can contribute positively to your credit history.

Requirements to receive a personal loan

Traditional lenders set their own criteria for personal loans, but they commonly evaluate your credit score, income, and existing debt to decide on your eligibility for a loan. A lower credit score could lead to loan rejection from traditional lenders like banks.

Having a lower credit score might result in a denial of your loan application by conventional banks. However, by applying through Primerates, you'll have access to an array of lenders offering diverse rates and numerous repayment plans for loans. Our simple and quick Primerates pre-qualification application makes the loan process easy. Once you're pre-qualified, you pick the best offer for you and finalize the loan application with the lender.

Before applying, make sure to compile the necessary documents, including these:

- Identification: Bring two forms, like a driver’s license, passport, or state ID.

- Employment Details: Have your employer's and supervisor's names, along with their email addresses and phone numbers, ready.

- Income Verification for Traditionally Employed: You will need your latest pay stubs, W-2s, 1099s, tax returns, or bank statements.

- Income Verification for Self-Employed: Gather your 1099s, tax returns, or bank statements.

- Proof of Residency: Collect documents like your lease agreement, mortgage statement, utility bill, property tax bill, voter registration, or insurance bill.

Cost of a 35k loan in the long run

The long-term cost of a $35,000 loan depends on the interest rate, the loan term, and any applicable fees. Here’s a simplified way to understand the potential cost:

Interest Rate: This is the percentage of the loan amount the lender charges you for borrowing the money. Rates can vary widely based on your credit score, income, and the lender’s policies.

Loan Term: This is the length of time you have to repay the loan, which can also greatly affect the total interest paid over the life of the loan.

Fees: Origination fees, processing fees, and late payment fees can also add to the cost of your loan.

The total cost of a loan is influenced by its interest rate and the duration of the loan term. Choosing a shorter repayment term can help reduce the total cost of borrowing. Although this results in higher monthly payments, the overall interest paid will be less. Additionally, a shorter loan term often comes with a lower interest rate.

For example, suppose you take out a $35,000 loan with an interest rate of 10% on a 5-year repayment plan, and let’s ignore any fees for simplicity. Using a basic loan amortization formula, your monthly payments would be approximately $743.65. Over the life of the loan, you would pay back a total of approximately $44,619, which includes about $9,619 in interest on top of the original $35,000 borrowed. It's important to use a loan calculator or consult with a financial advisor to get a precise figure based on the specific terms offered to you.

How to get a 35000 loan with bad credit

In order to apply for a personal loan of up to 35,000 loan, you should have your personal credit score and recent bank statements. Once you apply, it is up to the many lenders to approve your application.

Securing a $35,000 loan with bad credit involves several preparatory steps to enhance your application's appeal to lenders. Know your current credit score to understand where you stand in lenders' eyes, because this may influence their decision. Prepare recent bank statements that highlight your financial stability and income, along with your personal contact details to ensure lenders can easily reach you.

Some lenders might request a personal statement explaining the motive behind your loan application and your plans for utilizing the funds. This statement can be a chance to make a case for yourself, particularly if your credit score doesn't fully reflect your current financial situation or your capacity to repay the loan.

When you're ready to apply, presenting this information clearly and comprehensively can make a significant difference. Despite having bad credit, a well-prepared application can showcase your financial responsibility and planning, making it easier for lenders to consider your request. Remember, lending markets are diverse, and while some lenders may hesitate, others specialize in working with individuals who have less-than-perfect credit. Your application then becomes a competitive option for various lenders, and it's their job to decide whether to extend an offer. By approaching the application process with thorough preparation and clear communication, you increase your chances of securing the loan you need, even with bad credit.

Primerates is your convenient solution if you have bad credit and you need a personal loan. You don’t need collateral for Primerate lenders. Our lenders have reasonable rates and are available for most credit types. Our lenders offer loan amounts from $1500 up to $100,000. Our lenders take more than your credit score into account when evaluating your loan application. They consider your income, your employment history, your debt ratio, and what you plan to do with the loan. Primerates streamlines the entire loan process, so you can pre-qualify with one easy online application. After you are pre-qualified, you can pick the offer that works best for your situation and complete the loan application directly with the lender you have picked.

Conclusion

Most personal loans of up to $35,000 can fund within as little as a few business days, and often come with flexible repayment terms. Lenders like LightStream, FreedomPlus and BestEgg offer low-APR loans to highly qualified borrowers. No matter what your credit score or annual income look like, however, make sure to compare multiple lenders and offers before making a decision on the loan that’s right for you.

Top Personal Loan Articles

- Home Improvement Loans & Financing

- HVAC Financing For Good & Bad Credit

- Kitchen Remodel Financing

- Basement Remodel Financing

- Plumbing Work & Repair Financing

- Roof Financing For Good & Bad Credit

- Hot Tub Financing For Good & Bad Credit

- Swimming Pool Financing For Good & Bad Credit

- Contractor Financing