Recent moves by the nation’s central bank have triggered a cascade of events that can spell big trouble if you own a credit card.

After years of keeping a lid on interest rates, the Federal Reserve has hiked its benchmark rate five times since December 2015.

Every time the Fed raises its main rate — known as the federal funds rate — it forces up the prime rate, which is the rate U.S. banks charge to their best customers when lending money.

In turn, a rising prime rate usually means higher rates on credit cards – and greater borrowing costs for you.

“Most credit cards carry variable rates tied to the prime rate. As interest rates rise, credit card rates rise,” says Gerri Detweiler, education director for Nav, a site that helps business owners monitor business and personal credit for free.

How much will your credit card rate rise?

So, how much do rate increases cost you? Typically, your credit card rate will increase by about the same measure as the rise in the prime rate.

In December, the Federal Reserve hiked its federal funds rate by quarter-point, to a “target range” of 1.25% to 1.5%. A corresponding rise in the prime rate – from 4.25% to 4.5% – quickly followed.

So, if your credit card rate was 15%, you could expect a jump to 15.25% thanks to the most recent rise in the prime rate.

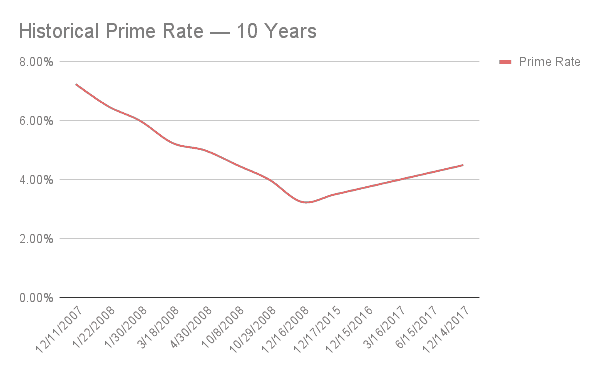

Here’s a look at the prime rate over the last 10 years:

As bad as that sounds, things are likely to get worse. In December, the U.S. central bank’s Federal Open Market Committee projected three more rate increases for 2018, and two more for 2019.

No one can be sure if the Fed will make good on that forecast. But U.S. interest rates generally are headed higher after years of remaining historically low in the wake of the Great Recession.

While the prime rate is expected to rise slowly, don’t let the modest pace of increases lull you into a false sense of security.

“These increases will seem small to consumers,” Detweiler says. “But if you have a lot of debt, they can add up over time.”

Compare Credit Cards

How to react to rising credit card rates

Detweiler says acting now can help keep you out of debt trouble as rates rise.

“The best thing you can do to protect yourself from rising rates is to pay your credit cards in full,” she says.

If you cannot get rid of your debt, at least try to minimize its impact. The first step is to check your credit reports and scores.

Then, do whatever you can to make sure your credit score is as strong as possible.

“The better your credit, the easier it will be to qualify for better offers,” Detweiler says.

Detweiler suggests consolidating debts you cannot pay off so that you get a lower rate on the remaining debt. A balance transfer to a credit card offering a low – or even zero – rate for a specified period is one way to do this.

“You want to try to get a fixed rate for as long as possible, so you’ll have time to pay off your balances before the rate jumps again,” Detweiler says.

Rate hikes and rate cuts occur in cycles. At some point – probably far into the future – the Federal Reserve will lower interest rates in hopes of boosting economic growth. When that happens, the prime rate will fall, and so will the rate on your credit cards.

But for now, a prolonged cycle of rate hikes is likely to continue. If you have a credit card, consider yourself warned.