Shop and Compare Loans & Credit Card Rates

Find the right offer for you in just minutes!

Personal Loans

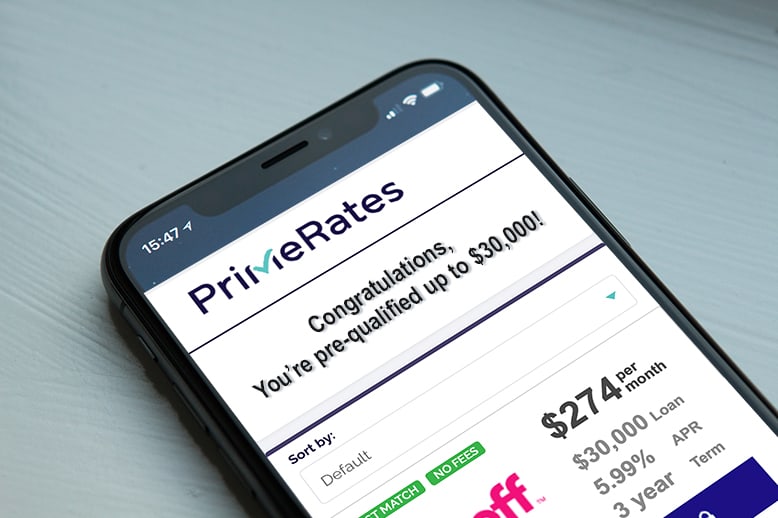

PrimeRates provides access to personalized loan offers through our simple and quick pre-qualification application. Once you're pre-qualified, you can select the best offer for you and finalize the loan application with the lender.

Apply in minutes

Simple pre-qual application in less than 1 minute.

Select your loan offer

Choose the offer that best fits your needs.

Receive funds quickly

Finalize your loan offer, get approved, and receive funds in at little as one business day.

Business Loans

Creating capital for your business is the gateway to expansion and success. If you do not have enough cash available, using a business loan can be a smart way to invest in the growth of your business.

Credit Cards

Whether you’re just starting out with no credit, bad credit, rebuilding credit, have fair credit, or looking for the card that earns better rewards, finding the right card can be a challenge. We’ve partnered with leading card issuers to make it easy to compare credit card rates and benefits all in one place such as Visa and Mastercard. And we do our best to keep our information accurate and up to date.

What does PrimeRates do?

Comparing rates and fees on loans and credit cards can be frustrating. How can you be sure you’ll get the rate, payments, or terms are shown? PrimeRates is changing that. We’ll help you prequalify with our lender partners, ensuring that the rates you see are the rates you’re more likely to get.

Learn if no credit check loans are safe, understand their risks, and get tips to avoid costly mistakes. Make informed financial decisions with expert guidance.

Read More →

Looking for personal loans for bad credit? Learn how to get approved, compare interest rates, and find lenders who work with lower credit scores.

Read More →

Learn how to use visa gift card online with our complete guide. Follow step-by-step instructions to shop confidently and maximize your card's value.

Read More →

Want to buy someone the perfect gift this holiday season? Look no further than a gift card. Here's a breakdown of different types of gift cards you can get.

Read More →

Wondering how to get a credit card for bad credit? A number of card issuers are offering great options. Here's how to land a card that fits your situation.

Read More →

Fortunately, if you want to apply for a personal loan, it's typically less of a hassle than qualifying for other types of loans. Here's what you'll need.

Read More →

Best Online Loans for Every Situation — Fast, Easy & Secure

Get approved for online loans today! Compare payday, personal, and bad credit loan options — even with no credit. Fast cash, secure process, trusted lenders.

Online Loans Made Simple — Fast Approval, No Hassle

Introduction

Introduction

In today’s unpredictable world, financial challenges can strike at any moment. Whether it’s a surprise medical bill, urgent car repair, or just making it through to payday, online loans offer a fast and flexible solution. At PrimeRates, we help you find the right type of loan — from payday to personal loans, even if you have bad credit or no credit history.

Looking for quick cash, instant approval, or a tribal loan alternative? You're in the right place.

What Are Online Loans?

What Are Online Loans?

Online loans are financial products offered via digital platforms, allowing you to apply and get approved without visiting a bank or credit union. These include:

Payday loans for short-term needs

Personal loans for larger or longer-term expenses

Bad credit loans for those with a low credit score

Emergency loans for unexpected situations

Tribal loans for alternatives to traditional lending

The entire process — application, approval, and disbursement — can happen within a few hours.

Why Online Loans Are Important

Why Online Loans Are Important

Speed: Get cash in as little as 24 hours

Convenience: Apply from home, anytime

Accessibility: Available to people with limited or poor credit

Choice: Compare lenders, terms, and rates instantly

Security: Encrypted applications protect your data

Online lending is no longer a niche — it's the new standard for modern financial services.

How Do Online Loans Work?

How Do Online Loans Work?

Step-by-Step:

Choose a Loan Type

Identify your need — emergency cash, debt consolidation, unexpected bills.

Fill Out an Application

Submit basic information (income, employment, ID, etc.) via secure form.

Get Matched with Lenders

PrimeRates uses smart algorithms to connect you with trusted offers.

Review & Accept Terms

Compare rates, repayment schedules, and conditions.

Receive Funds

In most cases, money is deposited within 24 hours.

Common Mistakes to Avoid

Common Mistakes to Avoid

Not comparing offers — Don’t settle for the first approval

Ignoring APR — Always check interest rates and fees

Borrowing more than needed — It increases repayment stress

Missing repayment dates — Leads to penalties and credit damage

Real-Life Example

Real-Life Example:

Sarah, a freelancer, had an unexpected dental emergency. With no savings and a low credit score, she used PrimeRates to find a bad credit loan with no credit check. The application took 5 minutes, and funds were in her account the next morning. No calls, no waiting in line, no judgment.

Final Thoughts & Recommendations

Final Thoughts & Recommendations

Online loans are more than just a quick fix — they’re a powerful financial tool when used responsibly. Whether you need $100 or $5,000, whether your credit is excellent or nonexistent, PrimeRates helps you access cash fast, safely, and securely.

Ready to get started?

Compare your options, apply in minutes, and take control of your finances today.

FAQ

Q: Can I get an online loan with bad credit?

A: Yes. Many lenders offer bad credit loans, including no credit check options.

Q: How fast can I receive funds?

A: In many cases, you can get money the same day or within 24 hours.

Q: Are tribal loans safe?

A: Tribal loans are legal and regulated within tribal jurisdictions. Always read the terms.

Q: Will applying affect my credit score?

A: Checking rates through PrimeRates does not impact your credit (soft check only).

Q: What is the minimum credit score required?

A: Some lenders accept applicants with no credit history at all.

👉 Start your application now and get matched with top online lenders in minutes.

Whether it's a payday loan, a no credit loan, or just emergency cash, PrimeRates is your fast and reliable partner.

Sources: CFPB, Experian, NerdWallet