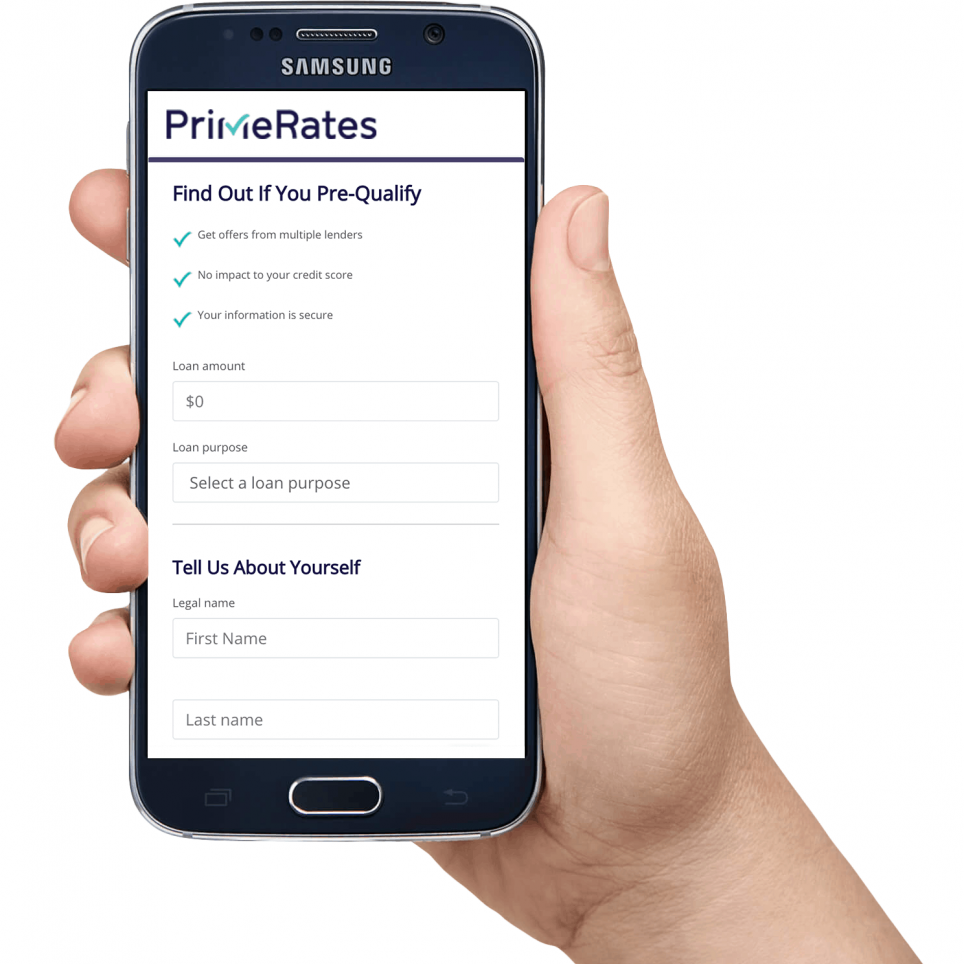

How PrimeRates Works

PrimeRates provides access to personalized loan offers through our simple and quick pre-qualification application. Once you're pre-qualified, you can select the best offer for you and finalize the loan application with the lender.

Apply in minutes

Simple pre-qual application in less than 1 minute.

Select your loan offer

Choose the offer that best fits your needs.

Receive funds quickly

Finalize your loan offer, get approved, and receive funds.

How to Shop For a Personal Loan

Trying to shop for a personal loan and get a good deal may take some work. But these financial products are fantastic tools for covering a number of expenses, from consolidating credit card debt to financing a vacation.

And they are becoming more popular. In fact, originations on personal loans rose 6.9% in the third quarter of 2017 compared to a year prior, according to data from Transunion. There are now more than 18 million personal loans in the marketplace.

But what's the best strategy to shop for a personal loan? And how do you compare offers? We've got you covered.

Here’s how to shop for a personal loan and get the most value for your money:

1. Borrow as little as possible

Start off by figuring out how much you really need to borrow. Keep it as low as possible to keep interest payments low. It will help ensure that you can pay back the loan without running into any snags. Indeed, Bruce McClary, vice president of communications for the National Foundation for Credit Counseling, backs up this strategy. “You want to make sure you borrow the least,” says McClary. “That is always the best strategy.”

2. Check your credit

To ensure you get a great interest rate, keep your credit in check. Take the time to analyze your credit reports before you shop for a personal loan. “It’s important to know where you stand before you start shopping around,” McClary says.

Identify any problems on your credit report that might be hurting your credit score, such as a mistaken entry in the file, credit card fraud, or identity theft. Then call the credit agency and get the issue resolved. “The last time you want to find out about (this) is when you’re sitting in front of a lender and it’s time to borrow money,” McClary says.

Compare Personal Loans

3. Choose a reputable lender

Some lenders simply aren't as trustworthy as others. So, make sure the company lending you money is on the up and up. “It’s just as important where you get the loan as the terms and conditions of the loan,” McClary advises. “Ideally, you want to get the financing you are looking for from a lender you can trust.”

That means checking things like their Better Business Bureau rating, reading reviews and checking sites like PrimeRates.com for their analysis of the company. Steer clear of predatory lenders and lenders that charge excessive interest rates and fees on their loan products. “Don’t hesitate to stop the process,” McClary says. “You don’t ever want to sign a document that you don’t fully understand.”

4. Check out lenders that already know you

A good place to look for a personal loan is with a company that you already do business with. “It might be a good idea to start with your bank and credit union to see what’s available,” McClary explains. But don't just shop for a personal loan with one resource, McClary advises. It's crucial to shop around a number of institutions in order to get the best deal possible.

5. Shop Online

Online lenders — like SoFi — have become a mainstay in the business. And many of them have competitive products. But McClary advises paying close attention to the fees, which can certainly increase the cost of the loan. You can use our personal loan marketplace to compare terms, fees, and estimated monthly payments.

The bottom line

After all the hard work and homework, shopping for a personal loan comes down to making smart choices — you want the best deal for your wallet. “Shop competitively,” McClary advises. “You want the lowest interest rate with the fewest fees.”

Compare Personal Loans

PrimeRates Lender Partner Network

LightStream

Prosper

Upgrade

BestEgg

SoFi

Payoff

LendingPoint

FreedomPlus

OneMain

Avant

LendingClub

Marcus